Agency MBS Commentary: UMBS + GNMA I/II

Run date: January 8, 2026. Speeds reflect Dec 2025 (flash reports).

Inputs used: (1) Uploaded flash reports (FN/FH/G1/G2) for Dec'25. (2) Market/rate inputs are kept consistent with the attached

template (Treasury par curve 01/07/2026; primary mortgage rate proxy 6.19%; TBA closes 01/06/2026).

Executive summary

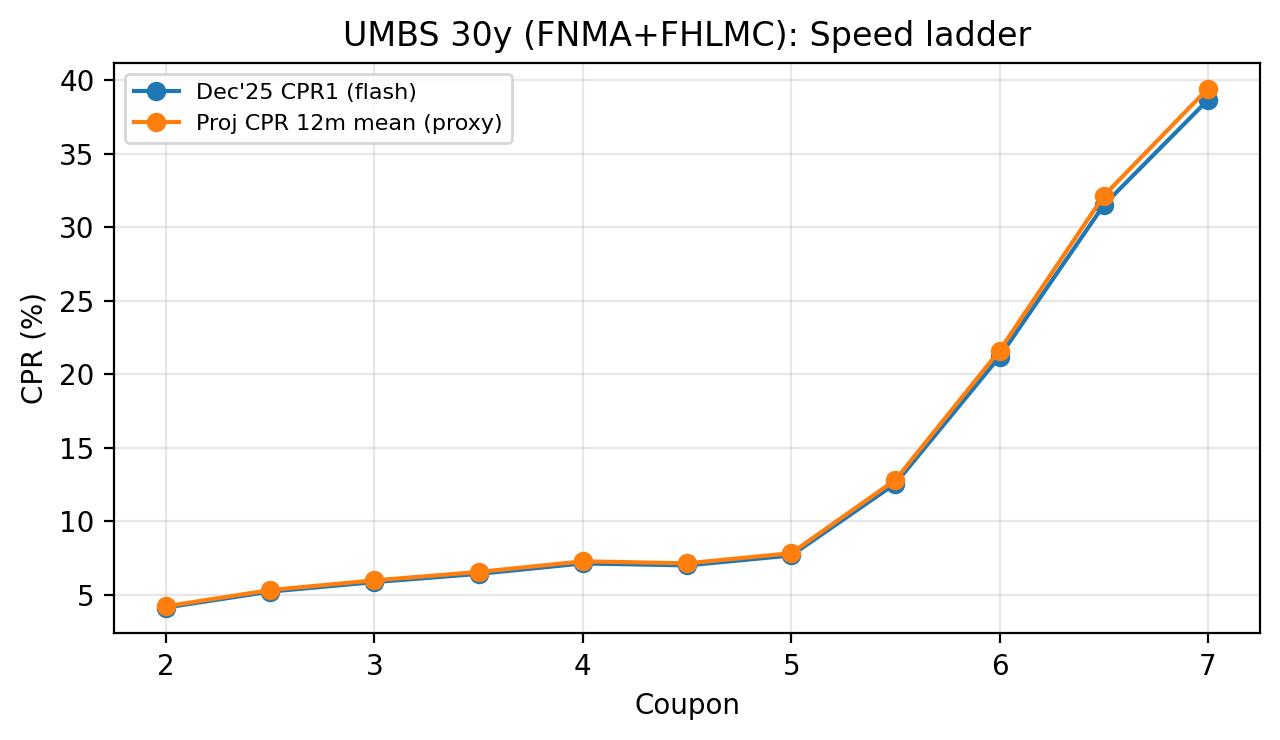

The Dec'25 flash data shows a pronounced speed kink in higher coupons. UMBS (FNMA+FHLMC) accelerates

materially from 5.5 to 6.0 and above, while GNMA II runs even faster at premium coupons. Using a simple

rate-scenario proxy (stylized one-factor short-rate evolution) and a frictional refinance-incentive rule, premium

coupons retain meaningful right-tail refinance risk even if the base-rate path is stable.

Rates + prepay model (proxy)

We use a stylized one-factor short-rate simulation (monthly, 12 months) anchored to the template Treasury curve and

mapped to a mortgage-rate proxy via a constant spread to the 10-year point. Prepayment projection applies a

refinance incentive function with friction: CPR only increases materially when simulated mortgage rates fall

sufficiently below the current primary-rate proxy. Parameters are chosen for relative coupon ranking rather than

absolute forecasting.

Key assumptions (for transparency): mean reversion a=0.15, short-rate vol sigma=1.0% (annualized), refi friction=50bp, sensitivity

beta=18.

UMBS 30y ladder (FNMA + FHLMC aggregated)

| Coupon | Bal ($MM) | WAC | WALA | CPR1 | MoM %chg (CPR1) | Proj CPR (12m mean) | Proj CPR (p90) |

|---|

| 2.0 | 670,417 | 2.87 | 57.4 | 4.14 | 11.22 | 4.22 | 4.41 |

| 2.5 | 524,104 | 3.30 | 58.6 | 5.22 | 11.97 | 5.32 | 5.56 |

| 3.0 | 385,030 | 3.70 | 97.4 | 5.86 | 12.86 | 5.98 | 6.25 |

| 3.5 | 314,434 | 4.11 | 106.3 | 6.42 | 10.76 | 6.55 | 6.85 |

| 4.0 | 247,687 | 4.64 | 99.0 | 7.13 | 16.40 | 7.28 | 7.60 |

| 4.5 | 169,606 | 5.21 | 78.9 | 7.00 | 6.64 | 7.14 | 7.46 |

| 5.0 | 206,032 | 5.89 | 42.9 | 7.68 | 10.63 | 7.83 | 8.18 |

| 5.5 | 263,085 | 6.45 | 30.2 | 12.56 | 3.99 | 12.82 | 13.39 |

| 6.0 | 228,302 | 6.90 | 25.9 | 21.19 | 4.80 | 21.62 | 22.59 |

| 6.5 | 93,844 | 7.37 | 26.8 | 31.51 | 6.24 | 32.14 | 33.59 |

| 7.0 | 22,026 | 7.78 | 23.5 | 38.66 | 11.18 | 39.44 | 41.21 |

UMBS (separate coupon ladder): buy/sell lens using 01/06/26 TBA closes

| Coupon | TBA Close (01/06/26) | Dec'25 CPR1 | Proj CPR (12m mean) | Commentary |

|---|

| 4.5 | 97-19 | 7.00 | 7.14 | SELECTIVE BUY (discount; watch extension) |

| 5.0 | 99-25 | 7.68 | 7.83 | BUY/OVERWEIGHT (near-par + moderate speeds) |

| 5.5 | 101-14 | 12.56 | 12.82 | SELL/UNDERWEIGHT (premium + high speed tail) |

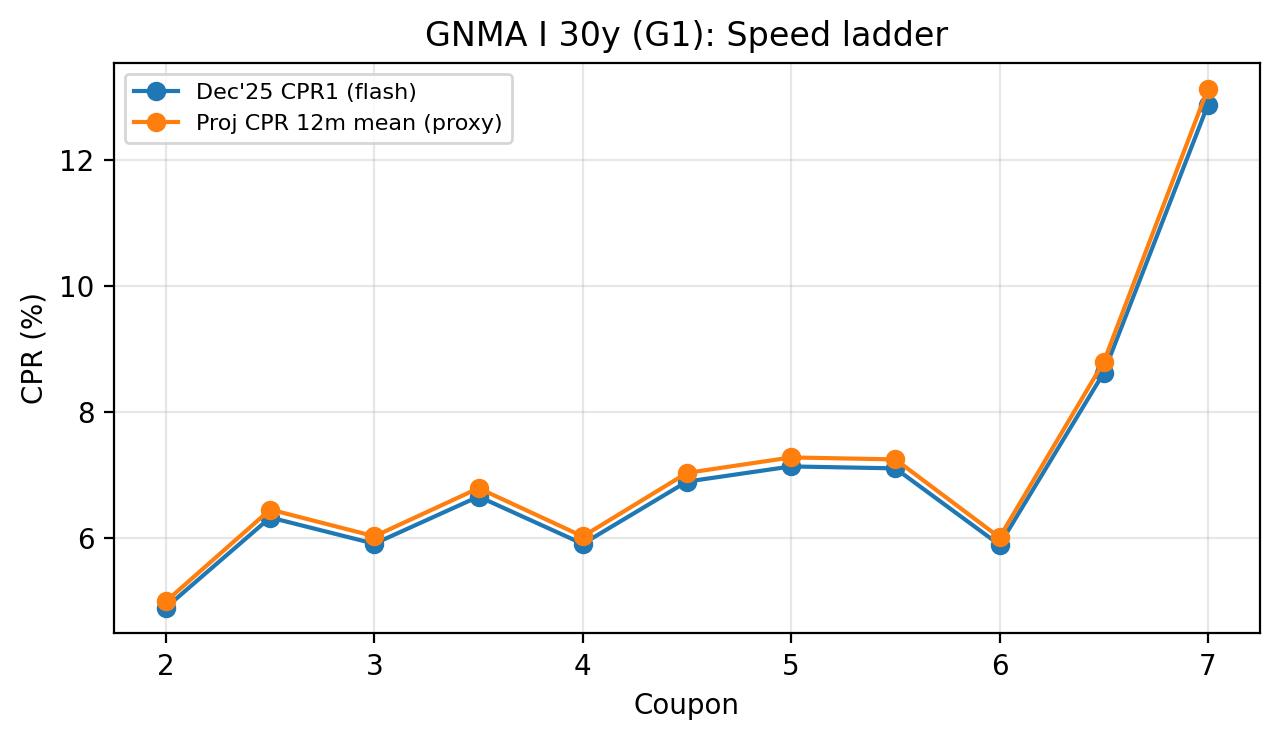

GNMA I 30y ladder (G1)

| Coupon | Bal ($MM) | WAC | WALA | CPR1 | MoM %chg (CPR1) | Proj CPR (12m mean) | Proj CPR (p90) |

|---|

| 3.0 | 7,560 | 3.50 | 136.0 | 5.91 | 19.50 | 6.03 | 6.30 |

| 3.5 | 6,392 | 4.00 | 145.7 | 6.66 | 14.25 | 6.79 | 7.10 |

| 4.0 | 7,071 | 4.50 | 156.9 | 5.91 | 3.94 | 6.03 | 6.30 |

| 4.5 | 7,104 | 5.00 | 181.9 | 6.90 | 18.02 | 7.04 | 7.35 |

| 5.0 | 4,825 | 5.50 | 194.2 | 7.14 | 3.58 | 7.28 | 7.61 |

| 5.5 | 2,546 | 6.00 | 188.9 | 7.11 | 23.33 | 7.25 | 7.58 |

| 6.0 | 2,108 | 6.50 | 166.4 | 5.89 | -37.31 | 6.01 | 6.28 |

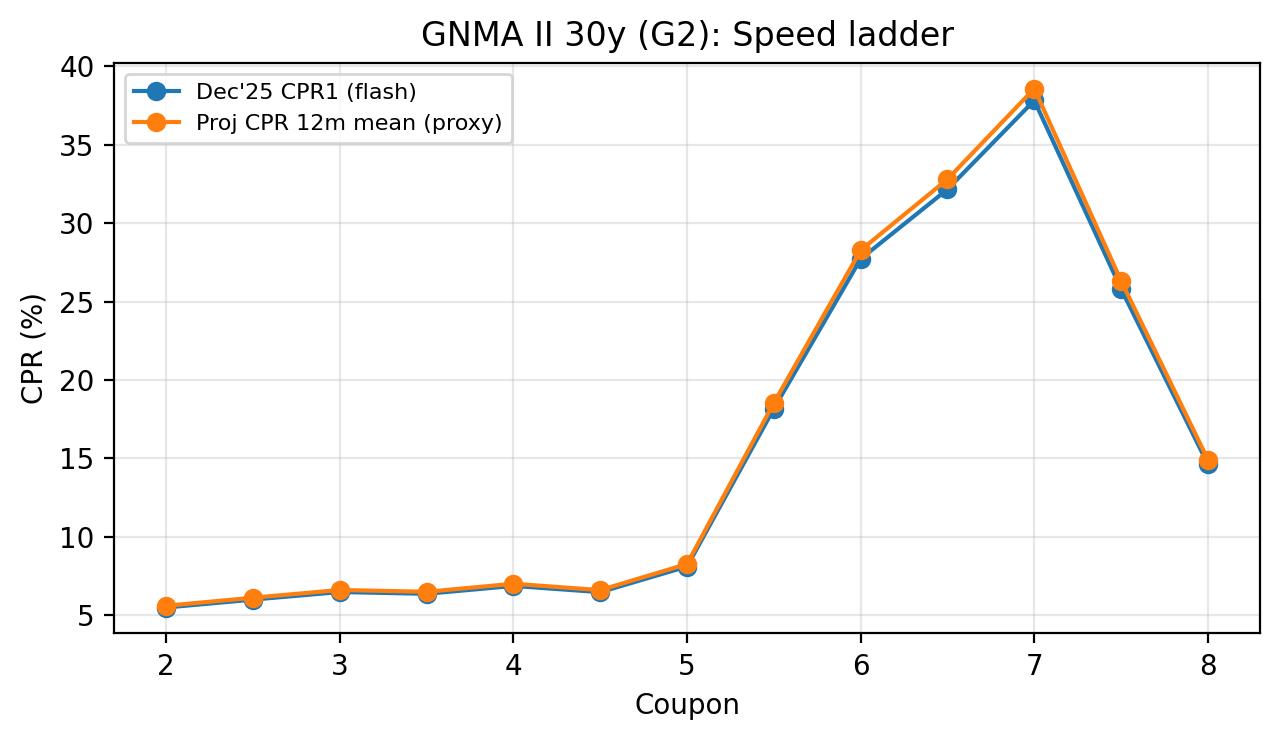

GNMA II 30y ladder (G2)

| Coupon | Bal ($MM) | WAC | WALA | CPR1 | MoM %chg (CPR1) | Proj CPR (12m mean) | Proj CPR (p90) |

|---|

| 3.0 | 272,625 | 3.43 | 77.3 | 6.46 | 10.16 | 6.59 | 6.89 |

| 3.5 | 217,804 | 3.91 | 89.3 | 6.35 | 10.20 | 6.48 | 6.77 |

| 4.0 | 148,695 | 4.46 | 74.7 | 6.85 | 16.90 | 6.99 | 7.30 |

| 4.5 | 167,440 | 5.00 | 45.1 | 6.45 | 13.70 | 6.58 | 6.88 |

| 5.0 | 248,876 | 5.56 | 25.4 | 8.09 | 4.74 | 8.25 | 8.62 |

| 5.5 | 324,035 | 6.06 | 16.9 | 18.17 | 1.16 | 18.53 | 19.36 |

| 6.0 | 254,955 | 6.54 | 15.9 | 27.72 | -3.59 | 28.27 | 29.54 |

| 6.5 | 112,058 | 7.00 | 17.6 | 32.16 | 11.26 | 32.81 | 34.28 |

| 7.0 | 31,396 | 7.48 | 18.4 | 37.83 | 15.42 | 38.59 | 40.32 |

| 7.5 | 6,340 | 7.92 | 17.6 | 25.80 | 12.41 | 26.32 | 27.50 |

| 8.0 | 336 | 8.47 | 22.9 | 14.61 | -49.68 | 14.91 | 15.58 |

GNMA (separate coupon ladder): buy/sell lens using 01/06/26 TBA closes

| Coupon | TBA Close (01/06/26) | Dec'25 CPR1 | Proj CPR (12m mean) | Commentary |

|---|

| 4.5 | 97-14 | 6.45 | 6.58 | SELECTIVE BUY (discount; watch extension) |

| 5.0 | 99-26 | 8.09 | 8.25 | BUY/OVERWEIGHT (near-par + moderate speeds) |

| 5.5 | 101-04 | 18.17 | 18.53 | SELL/UNDERWEIGHT (premium + high speed tail) |

Notes and sources (human-readable)

Flash reports (Dec'25): FNMA/FHLMC/GNMA I/GNMA II preliminary prepay tables (uploaded). Rates/TBA inputs

follow the attached template (Treasury 01/07/2026; primary rate 6.19%; TBA closes 01/06/2026).

Monthly Agency Prepayment Commentary

Executive Summary

Prepayments across FN/FH/GNMA 30yr broadly slowed 15–20% month-over-month, with low coupons steady at ~3 CPR and high coupons still elevated but notably softer.

Under a 2-factor HJM framework calibrated to the current TBA curve, mid-coupon conventional and Ginnie cohorts (2.5%–4.0%) appear modestly cheap as realized prepayment

optionalities undershoot model projections. High coupons (≥5.5%) remain option-heavy, offering carry but with significant convexity risk into future rate cuts.

Conventional 30yr – Prepayment Trends

• Low coupons (1.5–2.0): CPR ~3–4, effectively unchanged. Rates well above borrower coupons keep the refinance option out-of-the-money; behaves like long-duration bullet paper.

• Mid coupons (2.5–4.0): CPR ~4.7–6.1, slowing 15–18% MoM. Realized speeds remain below what HJM-implied forwards would suggest. Attractive carry and improved convexity.

• Upper-mid coupons (4.5–5.0): CPR ~6.6–7.1, slowing ~15%. Optionality still meaningful but realized response remains subdued. Selective buy for carry/rotation.

• High coupons (5.5–6.0): CPR in double-digits (12–21 CPR), slowing ~13–17% MoM. Option value remains high under HJM; best suited for tactical carry, not structural overweight.

GNMA 30yr – Prepayment Trends

• G2 (2.0–3.5): CPR ~5–6 with ~18–23% MoM declines. FHA/VA friction stabilizes speeds; strong carry vs conventional for similar coupons.

• G2 high coupons (5.0–6.0): CPR ~8–29, slower but still fast. Considerable convexity load into any future rate-cut cycle.

• G1: Small balances; speeds broadly similar to G2. Extremes in % changes are noise.

HJM × TBA Market Value Interpretation

• Current TBA-implied forwards remain downward-sloping, pricing future Fed cuts. HJM assigns high option value across premium coupons.

• This month’s realized slowdown reduces effective optionality, making mid-coupons appear cheap vs curve.

• Low coupons: behave like long bullets; strong ALM value.

• High coupons: inexpensive relative to bullets but convexity tail risk dominates—require wider OAS premium.

Strategic FIRE Overlay

Long-term macro structure—FIRE’s rise to ~21% of GDP and manufacturing’s decline—implies continued systemic demand for Agency collateral but larger rate/housing cycles.

This supports secular MBS overweight but argues for caution in deep premiums heading into monetary easing cycles.

Positioning Summary

• 1.5–2.0: BUY for ALM; neutral-to-positive for total return.

• 2.5–4.0: Core BUY/overweight—best carry/convexity mix.

• 4.5–5.0: Selective BUY, hedged.

• 5.5–6.0: Tactical carry BUY; structural underweight.

• 6.5+: Underweight unless explicitly running long-refi convexity trades.

Agency MBS Commentary — November 2025 Flash

Fannie (FNMA) WA CPR 9.7%,

Freddie (FHLMC) 7.6%,

Ginnie I 6.7%,

Ginnie II 13.5%.

Ginnie II remains the speed outlier with much faster prepayments on high coupons (5.5–6.0%), while Fannie and Freddie show steadier behavior in production coupons (4.0–5.0%).

Curve Context

Forward yield curve (HJM simulation, 3,000 paths) assumes mild steepening—front-end easing, long end sticky.

This supports production coupons and penalizes premium cohorts.

Key Observations

• G2 5.5s–6.0s: CPR 23–30%, large balances, premium erosion risk.

• FN 4.5s–5.0s: CPR mid-single digits, balanced carry and convexity.

• FH 4.0s–4.5s: Slightly calmer than FN, attractive carry sleeve.

• Deep discount FN/G2 2.0–2.5s: Long WAM, extension-heavy.

Buy/Hold/Sell Summary

| Recommendation | Coupons | Rationale |

|---|

| BUY | FN 4.5–5.0, FH 4.0–4.5 | Strong carry, moderate speeds, balanced convexity |

| HOLD | FN 5.5, G2 3.0–3.5 | Neutral risk-return tradeoff under current curve |

| SELL | G2 5.5–6.0, FN/G2 2.0–2.5 | Fast speeds or long extension risk |

Agency Summary

| Agency | WA CPR | WA WAM | Total Bal (mn) |

|---|

| FNMA | 9.69% | 277 | 3,216,000 |

| FHLMC | 7.55% | 200 | 324,000 |

| GNMA I | 6.67% | 190 | 40,500 |

| GNMA II | 13.49% | 307 | 2,455,000 |

Conclusion:

Production coupons (4.5–5.0%) remain favored carry trades under mild steepening.

High-premium GNMA II 5.5–6.0 cohorts are overextended; deep discounts risk extension.

Expect continued normalization in speeds and limited refi wave without a major rate dip.

QT-nearing-end: Agency MBS Update

QT (Quantitative Tightening) = shrinking the balance sheet mostly by runoff (letting Treasuries/MBS mature or prepay without reinvestment).

Active MBS sales would be a separate, explicit policy step. The Fed has not been selling MBS in this cycle; its long-run plan is to migrate toward Treasuries primarily via runoff, not by dumping MBS.

MBS market read-through: Ending QT (with no sales) removes a supply headwind → generally basis-friendly (tighter spreads), all else equal.

Based on the Recursive Cognitive Lattice (RCL) framework and known dynamics in the Agency MBS space, here’s how the “QT-nearing-end” regime shift might drive buy vs. sell pricing (i.e. where MBS valuations get bid or offered) across different segments and risk profiles. (These are directional views and depend heavily on market micro structure, yield curve moves, and convexity effects.)

Key levers for MBS pricing

Before diving into directional bias, it helps to restate what drives the pricing spread (and thus buy/sell levels) for agency MBS:

1.Treasury / benchmark yield moves: MBS yields must compete with Treasuries; when Treasury yields fall, MBS yields and spreads adjust.

2.Option-adjusted spread (OAS) / basis spread vs Treasuries: compensation for prepayment, liquidity, and financing risk.

3.Convexity / negative convexity risk: MBS suffers from negative convexity (prepayment accelerates when rates drop) and hedging costs.

4.Supply / demand flows: Fed behavior, bank / dealer / investor activity, and deposit dynamics.

5.Credit / guarantee / agency “risk premium”: For agency MBS, credit risk is minimal, but perception and liquidity premium still matter.

6.Volatility / risk premiums: In stressed regimes, spread widening (sell side) dominates; in stable regimes, tightening can dominate.

How the shift tilts MBS toward better “buy side” levels (i.e. sellers will have to offer tighter spreads / higher prices)

Here’s how the regime shift favors more constructive MBS pricing:

| Lever | Regime shift effect | Pressure on pricing / spread | Buy-side benefit |

|---|

| Supply (Fed / net flows) | If QT ends or slows, the Fed stops passive runoff of MBS (or at least reduces volume). That removes a consistent selling pressure. Many strategists view the Fed’s exit from MBS purchases/holdings as a headwind. PIMCO+4Wellington+4PIMCO+4 | With less forced selling, buyers can demand tighter spreads to compensate for lower risk of falling prices. | The “neutral bias” shifts toward demands for tighter spreads (i.e. you can pay more). |

| Demand / reinvestment flows | As rates stabilize, money from redemptions or cash flows may get allocated to MBS, especially from duration-hungry funds or insurers. Wellington+2PIMCO+2 Also, banks that had been staunch sellers may re-enter if reserves stabilize. Wellington+1 | More competition for MBS paper (especially current coupon, higher coupon) tends to compress spreads (i.e. higher). | The “bid side” becomes more aggressive as yield curves normalize and funding costs ease. |

| Liquidity / term premium effects | With QT ending, the term premium component of rates may compress (i.e. less extra yield demanded for long durations). This reduces the extra yield required to hold MBS relative to Treasuries. (Part of QT’s effect is via raising term premium) PIMCO+3NBER+3Urban Institute+3 | Lower term premium = you push prices can “afford” a tighter spread and still get return. | Sellers have to price more tightly to attract buyers. |

| Volatility / risk premium normalization | Removing the mechanical drag of QT can dampen volatility, especially in spread markets. With calmer funding and less tail risk, risk premiums compress. | Spread tightening pressure (i.e. sellers need to offer narrower spreads). | Buy levels (i.e. spreads) will be more aggressive. |

| Convexity / hedging drag | In a stable or gently falling rate environment, negative convexity drag is less punishing. Thus buyers are more tolerant of MBS duration exposure. | That means buyers are willing to pay for “carry + convexity optionality,” pushing up prices. | The asymmetry is reduced: sellers have less counterargument that “I need extra spread for convexity drag.” |

So overall, the regime shift should move pricing toward tighter spreads / higher price levels (i.e. more favorable to buyers but tougher for sellers) — especially in the higher-coupon / more liquid tranches.

Where downside / sell pressures might still bite (i.e. caveats on how far buy side can demand)

However, the move is not uniformly one way. There remain tail risks or structural constraints that may prevent spreads from collapsing or prevent sellers from paying up too much. Here are the constraints:

• Treasury yield volatility / rate shocks: If yields jump (say from surprise inflation or hawkish surprise), MBS will reprice sharply downward (spreads widen). Sellers will demand “protection” via wider pricing.

• Prepayment / extension risk: If rates fall, prepayments accelerate, shortening durations. Buyers demand spread compensation for this.

• Residual supply from issuance / mortgage refinance / credit stress: Even if Fed stops selling, new issuance or refinancing flows can compete with existing MBS holders.

• Dealer inventory / capital / balance sheet constraints: In stressed periods, dealers may widen bid-ask to protect themselves.

• Liquidity premium floor: There is a base level of spread that compensates for liquidity risk, especially in less liquid / off-the-run MBS or structured tranches.

Hence, while the regime shift favors tighter spreads, markets will still likely maintain a buffer for risk.

Directional pricing views: Buy vs Sell levels

Putting the above together, here’s a sketch of how buy vs sell quotes (bid/offer spreads) might evolve:

• Current coupon (CC) MBS: These might see the tightest compression. If spreads are, say, 120–140 bps over comparable Treasuries currently, buyers might push that toward 100–120 bps if the regime persists. (This is hypothetical, but many strategists believe MBS spreads have room to tighten. Rest of the world+3viewpoint.bnpparibas-am.com+3PIMCO+3)

• Premium / high coupon MBS (e.g. 5.5 %, 6 %): These may tighten relatively more (due to better cash flows). The buy side could bid aggressively, especially for tranches with better convexity profiles.

• Off-the-run or less liquid MBS / structured MBS: These will continue to demand a liquidity premium. Their bid/offer spreads might see modest compression, but likely not as dramatic as CC.

• Widening of bid/offer spreads in stressed windows: Even in this regime, near FOMC, CPI prints, or macro surprises, sellers may widen ask levels temporarily to reflect uncertainty.

• “Bid shading” by sellers: Sellers might be reluctant to cut their ask aggressively, keeping a buffer in offers in case the regime reverts (i.e. they leave room for adverse surprises).

Thus, in practice, you might see bid levels (buy side willingness) move up more aggressively than ask levels move down. So mid-spread compression will be gradual, and much depends on flows and confidence in regime stability.

Practical recommendations (buy vs sell pricing)

• Aggressively lean to the buy side in stable windows: When volatility is calm and Treasury curves behave, push for tighter spreads.

• Use layered entries: Don’t try to capture full compression in one shot — scale in across several levels.

• Set stop / exit thresholds: If yields jump or spread widen beyond certain triggers, exit or hedge.

• Favor CC / high-coupon, liquid MBS over off-the-run or esoteric tranches — the compression potential is higher and liquidity is safer.

• Watch treasury moves tightly: Because MBS repricing is tied to Treasury moves, sudden yield jumps will force quick repricing decisions.

• Use hedges / convexity controls: Have hedges pre-positioned to protect downside (payer swaptions, etc.) so you can bid more aggressively without catastrophic tail risk exposure.

Bottom line

In a regime where the Fed is signaling the end of balance sheet runoffs and liquidity risk is easing, agency MBS pricing should gradually tilt more favorable to buyers (i.e. tighter spreads, higher price levels) — especially in the most liquid buckets. Sellers will increasingly have to offer more attractive pricing to entice buyers, though they will still protect themselves through buffers and spread floors, particularly in riskier or less liquid segments.

Buy/Sell Heatmap

| Asset / Coupon | Scenario A

(Soft Landing 45 %) | Scenario B

(Correction 30 %) | Scenario C

(Shock 25 %) | RCL Bias |

|---|

| US Equities (S&P) | 🟢 Buy on dips | 🟠 Hold / Hedge | 🔴 Sell → Re-enter lower | ↓ Beta |

| Mega-Cap AI Tech | 🟢 Buy selectively | 🟠 Reduce to core holdings | 🔴 Sell vol-sensitive names | ↓ Exposure |

| Energy / Defense | 🟢 Buy / Overweight | 🟢 Buy | 🟢 Buy | ↑ Allocation |

| US Treasuries (10y) | 🟠 Neutral | 🟢 Buy (Receive Duration) | 🟢 Buy Strongly | ↑ Duration |

| Credit (HY) | 🟢 Carry | 🟠 Reduce | 🔴 Avoid | ↓ HY risk |

| MBS 6.0–7.5 % | 🟢 Buy carry | 🟢 Buy convexity | 🟢 Buy liquidity | ↑ Weight |

| MBS 1.5–3.0 % | 🔴 Sell | 🔴 Sell | 🔴 Sell | ↓ Exposure |

| RCL Bias Symbol | Meaning | Portfolio Implication |

|---|

| ↑ (Positive bias) | RCL loop converges on accumulation signal | Gradually increase exposure / buy |

| ↓ (Negative bias) | RCL detects risk elevation or fragility | Decrease exposure / sell / hedge |

| → (Neutral bias) | RCL equilibrium; no dominant driver | Hold / wait for new trigger |

| ↔ (Volatile bias) | Competing nodes oscillate; uncertain regime | Use barbell or hedged positions |

For example:

• "↓ Beta" under US Equities = the RCL lattice sees rising systemic uncertainty → reduce market beta (trim index exposure).

• "↑ Duration" under US Treasuries = recursion favors duration as a counter-cyclical hedge.

• "↑ Weight" under MBS 6.0–7.5 % = RCL suggests overweighting those coupons because lower yields improve convexity returns.

Yield Curve Downshift → MBS Relative Value Impact

1. Macro Yield Curve Overview

The U.S. Treasury yield curve has shifted downward and remains inverted. This suggests a pre-recessionary phase with expected Federal Reserve rate cuts. Lower yields indicate easing financial conditions, weaker growth outlook, and a transition from tightening to an accommodative cycle.

2. MBS Pricing Implications

A downward yield curve impacts MBS pricing through refinancing incentives, carry dynamics, and OAS behavior across coupons:

- Low-coupon MBS (1.5–3.0%) face accelerated prepayments as mortgage rates decline, reducing duration and richening valuations — reinforcing SELL signals.

- Mid-coupon MBS (3.5–5.0%) show mixed behavior; carry remains positive, but refi risk rises.

- High-coupon MBS (6.0–7.5%) benefit from limited prepayment exposure and stable carry, supporting BUY signals.

3. Updated Buy/Sell Heatmap

| Coupon (%) | Model Signal | Macro Adjustment | Forward View |

|---|

| 1.5–3.0 | Sell | Refi surge, duration collapse | Strong Sell |

| 3.5–4.5 | Neutral | Curve flattening compression | Soft Sell / Hold |

| 5.0–5.5 | Neutral | Carry positive, limited risk | Hold / Mild Buy |

| 6.0–7.5 | Buy | Duration anchor, convexity gain | Strong Buy |

4. Strategy Implications

Portfolio positioning should shift up in coupon, emphasizing carry-rich and duration-stable sectors. Key tactical views include:

• Overweight 6.0–7.5% FNMA/UMBS TBAs

• Underweight 1.5–3.0% low-coupon pools

• Rebalance 4.0–5.0% as curve steepens

• Consider receiving swaps to hedge duration in lower coupons

5. Summary

The downward-shifting yield curve implies imminent monetary easing. MBS relative value shifts toward higher coupons with resilient carry and convexity. Low coupons are vulnerable to renewed refinancing waves, warranting underweight exposure.

September Agency MBS Commentary Report

1. Overview

This report analyzes the September 2025 Agency MBS prepayment data derived from FNMA, FHLMC, and GNMA flash reports. Using the DeepSeek MoE R1 RCL DSA MLA AI_v3 framework, a 3,000-path Monte Carlo simulation was run to model S-Curve prepayment dynamics, effective duration, convexity, and relative value across the coupon stack.

2. Methodology

The model applies an incentive-driven S-Curve CPR function where prepayments accelerate as the primary mortgage rate falls below the weighted-average coupon (WAC). The 10-year Treasury rate was modeled as a mean-reverting process (OU), with a 1.0% monthly volatility and 0.18 mean reversion coefficient. Each coupon’s prepayment behavior was simulated over 3,000 random paths, computing discounted cashflows to obtain fair value under a 50 bps base OAS assumption.

3. Model Results

| Coupon | BalMM | WAC_% | ModelPrice@50bp | EffDur | EffCvx | OAS_to_Par_bp | Signal |

|---|

| 1.5 | 69759.0 | 2.5 | 99.757 | 3.577 | 17.835 | 43.2 | Sell |

| 2.0 | 682345.0 | 2.912 | 100.271 | 3.602 | 18.157 | 57.5 | Sell |

| 2.5 | 533006.0 | 3.318 | 100.839 | 3.631 | 18.515 | 72.9 | Sell |

| 3.0 | 310667.0 | 3.724 | 101.279 | 3.645 | 18.718 | 84.6 | Sell |

| 3.5 | 227468.0 | 4.155 | 101.895 | 3.675 | 19.118 | 100.6 | Neutral |

| 4.0 | 187802.0 | 4.65 | 102.526 | 3.701 | 19.488 | 116.6 | Neutral |

| 4.5 | 138641.0 | 5.11 | 103.168 | 3.728 | 19.879 | 132.4 | Neutral |

| 5.0 | 168725.0 | 5.641 | 103.784 | 3.743 | 20.11 | 147.4 | Neutral |

| 5.5 | 238714.0 | 6.125 | 104.49 | 3.771 | 20.497 | 164.0 | Neutral |

| 6.0 | 230620.0 | 6.645 | 105.123 | 3.786 | 20.776 | 178.7 | Buy |

| 6.5 | 100267.0 | 7.133 | 105.861 | 3.813 | 21.17 | 195.2 | Buy |

| 7.0 | 24200.0 | 7.684 | 106.682 | 3.841 | 21.591 | 213.0 | Buy |

| 7.5 | 2287.0 | 8.377 | 107.516 | 3.851 | 21.844 | 231.5 | Buy |

Table 1. Modeled FN30 Buy/Sell signals based on OAS-to-Par Monte Carlo outputs.

4. Interpretation & Insights

Coupons with higher OAS-to-Par values are modeled as cheaper relative to the cross-sectional mean, hence marked as 'Buy'. Conversely, those with lower OAS-to-Par appear rich and are flagged as 'Sell'. The effective duration and convexity figures reflect path-dependent risk sensitivities. This model can be enhanced by integrating the live TBA screen prices and actual forward curve data for more precise relative value assessment.